SCHEDULE 14A

(RULE 14a-101)

Information Required in Proxy Statement

__________________________________

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

__________________________________

| | |

| Filed by the Registrant | ☒ |

| Filed by Party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ | |

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Material |

| ☐ | Soliciting Material under Rule 14a-12 |

Garrison Capital Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, If Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | | |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| ☐ | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | |

| | (1) | Amount previously paid: |

| | | |

| | (2) | Form, schedule or registration statement no.: |

| | | |

| | (3) | Filing party: |

| | | |

| | (4) | Date filed: |

| | | |

GARRISON CAPITAL INC.

1290 Avenue of the Americas, Suite 914

New York, New York 10104

March 21, 2017July [•], 2018

Dear Stockholder:

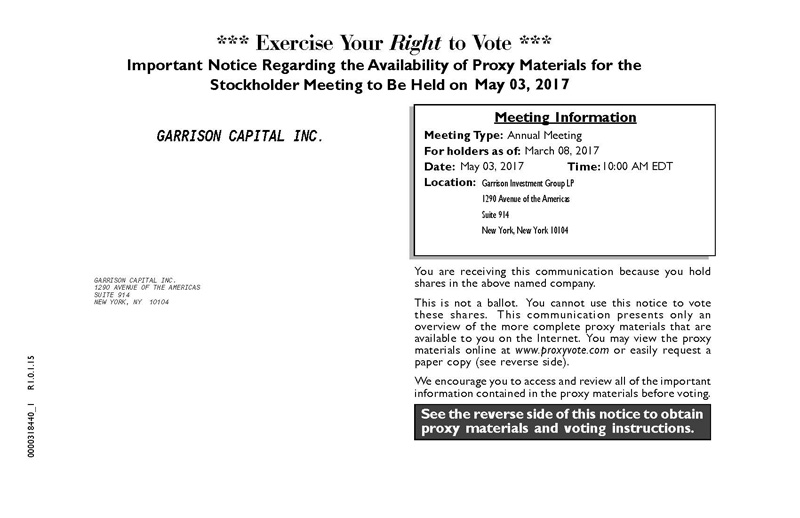

You are cordially invited to attend the 2017 Annuala Special Meeting of Stockholders (the “Annual“Special Meeting”) of Garrison Capital Inc. (the “Company”) to be held on May 3, 2017August 14, 2018 at 10:00 a.m., Eastern Time, at the offices of Garrison Investment Group LP, located at 1290 Avenue of the Americas, Suite 914, New York, New York.

The Notice of Annual Meeting of Stockholders and the proxy statement which are accessible on the Internet or by request, provideprovides an outline of the business to be conducted at the AnnualSpecial Meeting. At the AnnualSpecial Meeting, you will be asked to: (1) elect one directorto approve the application of the reduced asset coverage requirements in Section 61(a)(2) of the Investment Company and (2) approve a new investment advisory agreement betweenAct of 1940, as amended, to the Company, and Garrison Capital Advisers LLC,which would reduce the Company’s investment adviser. I will also report onasset coverage requirements applicable to the Company’s progress sinceCompany from 200% to 150%. The Board of Directors unanimously recommends a vote “FOR” the last meeting and respondapproval of the application of the reduced asset coverage requirements in Section 61(a)(2) of the 1940 Act to stockholders’ questions.the Company.

It is very important that your shares be represented at the AnnualSpecial Meeting. Even if you plan to attend the AnnualSpecial Meeting in person, I urge you to follow the instructions on the Notice ofenclosed proxy card and vote via the Internet Availability of Proxy Materials to vote youror telephone or by signing, dating and returning the proxy oncard in the Internet. We encouragepostage-paid envelope provided. Management encourages you to vote via the Internet, if possible, as it saves the Company significant time and processing costs. On the Notice of Internet Availability of Proxy Materials, you also will find instructions on how to request a hard copy of the proxy statement and proxy card free of charge, and you may vote your proxy by returning a proxy card to us after you request the hard copy materials. Your vote and participation in the governance of the Company are very important to us.management.

Sincerely yours,

/s/ Joseph Tansey

Joseph Tansey

Chief Executive Officer

GARRISON CAPITAL INC.

1290 Avenue of the Americas, Suite 914

New York, NY 10104

(212) 372-9590

NOTICE OF ANNUAL SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 3, 2017AUGUST 14, 2018

Notice is hereby given to the owners of shares of common stock (the “Stockholders”)stockholders of Garrison Capital Inc. (the “Company”) that:

The 2017 AnnualA Special Meeting of Stockholders (the “Annual“Special Meeting”) of the Company will be held at the offices of Garrison Investment Group LP, located at 1290 Avenue of the Americas, Suite 914, New York, New York, on May 3, 2017August 14, 2018 at 10:00 a.m., Eastern Time,Time. At the Special Meeting, stockholders of the Company will consider and vote on a proposal to approve the application of the reduced asset coverage requirements in Section 61(a)(2) of the Investment Company Act of 1940, as amended (the “1940 Act”), to the Company, which would reduce the asset coverage requirements applicable to the Company from 200% to 150%. These reduced asset coverage requirements were enacted into law on March 23, 2018 in the Small Business Credit Availability Act (the “SBCAA”). The SBCAA, among other things, amended Section 61(a) of the 1940 Act to add a new Section 61(a)(2) that reduces the asset coverage requirements applicable to business development companies (“BDCs”) from 200% to 150%. Under these modified asset coverage requirements, a BDC will be able to incur additional leverage, as the asset coverage requirements for senior securities (leverage) applicable to the following purposes:Company pursuant to Sections 18 and 61 of the 1940 Act will be reduced to 150% (equivalent to a 66-2/3% debt-to-total capital ratio) from 200% (equivalent to a 50% debt-to-total capital ratio).

| 1. | To elect one Class II director of the Company who will serve until the 2020 annual meeting of stockholders or until his successor is duly elected and qualifies; and |

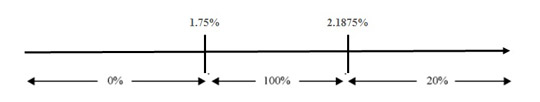

If this proposal is approved by stockholders, the Company and its investment adviser intend to reduce the base management fee payable under the fourth amended and restated investment advisory agreement between the Company and the investment adviser to an annual rate of 1.50% of the Company's average gross assets, excluding cash or cash equivalents but including assets purchased with borrowed funds, at the end of each of the two most recently completed calendar quarters; provided, however, the base management fee will be calculated at an annual rate of 1.00% of the average value of the Company’s gross assets, excluding cash or cash equivalents but including assets purchased with borrowed funds, that exceeds the product of (i) 200% and (ii) the Company’s average net assets at the end of each of the two most recently completed calendar quarters.

| 2. | To approve a new investment advisory agreement between the Company and Garrison Capital Advisers LLC, the Company’s investment adviser. |

If this proposal is not approved by stockholders, the Company will continue to operate within the 200% asset coverage requirements until March 28, 2019 (the one year anniversary of the approval of the application of the modified asset coverage requirements to the Company by its board of directors). Until such time, the Company would continue to operate in accordance with its current investment strategy.

You have the right to receive notice of, and to vote at, the AnnualSpecial Meeting if you were a Stockholderstockholder of record at the close of business on March 8, 2017. We are furnishing proxy materials to our Stockholders on the Internet, rather than mailing printed copies of those materials to each Stockholder. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials unless you request them. Instead, the Notice of Internet Availability of Proxy Materials will instruct you as to how you may access and review the proxy materials, and vote your proxy, on the Internet.July 3, 2018.

Your vote is extremely important to us.the Company. If you are unable to attend the AnnualSpecial Meeting, we encouragethe Company encourages you to vote your proxy on the Internet by following the instructions provided on the Notice ofenclosed proxy card and vote via the Internet Availability of Proxy Materials. You may also request from us, free of charge, hard copies ofor telephone or by signing, dating and returning the proxy statement and a proxy card by followingin the instructions on the Notice of Internet Availability of Proxy Materials.postage-paid envelope provided. In the event there are not sufficient votes for a quorum or to approve the proposalsproposal at the time of the AnnualSpecial Meeting, the AnnualSpecial Meeting may be adjourned in order to permit further solicitation of proxies by the Company.

THE BOARD OF DIRECTORS, INCLUDING EACHUNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE INDEPENDENT DIRECTORS,

UNANIMOUSLY RECOMMENDS THAT YOU VOTEFOR EACHAPPLICATION OF THE PROPOSALS.REDUCED ASSET COVERAGE REQUIREMENTS IN SECTION 61(A)(2) OF THE 1940 ACT TO THE COMPANY.

By Order of the Board of Directors,

/s/ Michael L. Butler

Michael L. Butler

Kaitlin Betancourt

Kaitlin Betancourt

Secretary

New York, New York

March 21, 2017

July [•], 2018

This is an important meeting. To ensure proper representation at the AnnualSpecial Meeting, please follow the instructions on the Notice of Internet Availability of Proxy Materials toenclosed proxy card and vote your proxy via the Internet or request, complete, sign, datetelephone or by signing, dating and return areturning the proxy card.card in the postage-paid envelope provided. Even if you vote your shares prior to the AnnualSpecial Meeting, you still may attend the AnnualSpecial Meeting and vote your shares in person if you wish to change your vote.

GARRISON CAPITAL INC.

1290 Avenue of the Americas, Suite 914

New York, NY 10104

(212) 372-9590

PROXY STATEMENT

For

2017 Annual

Special Meeting of Stockholders

To Be Held on May 3, 2017August 14, 2018

This document will give you the information you need to vote on the mattersproposal listed on the accompanying Notice of AnnualSpecial Meeting of Stockholders (“Notice of AnnualSpecial Meeting”). Much of the information in this proxy statement (“Proxy Statement”) is required under rules of the Securities and Exchange Commission (“SEC”), and some of it is technical in nature. If there is anything you do not understand, please contact usGarrison Capital Inc. (the “Company”) at (212) 372-9590.

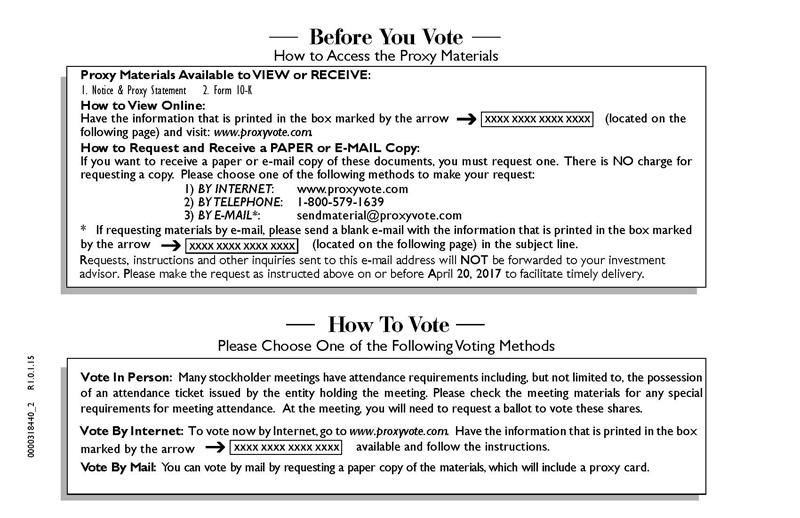

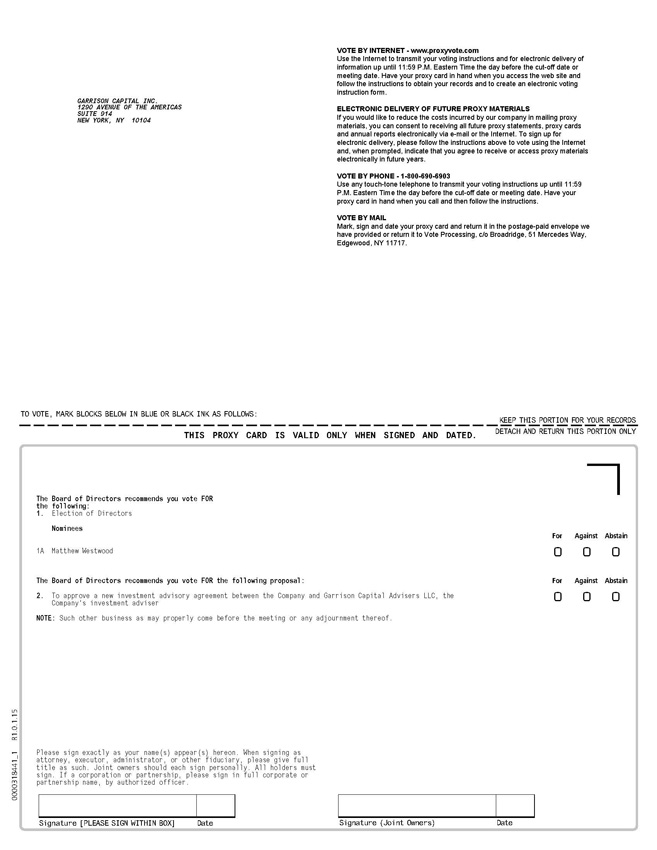

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Garrison Capital Inc. (the “Company,” “we,” “us” or “our”)the Company for use at our 2017 Annuala Special Meeting of Stockholders (the “Annual“Special Meeting”) to be held on Wednesday, May 3, 2017Tuesday, August 14, 2018 at 10:00 a.m., Eastern Time, at the offices of Garrison Investment Group LP (“Garrison Investment Group”), located at 1290 Avenue of the Americas, Suite 914, New York, New York, and at any postponements or adjournments thereof. This Proxy Statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2016 (the “Annual Report”) areis being providedsent to stockholders (“Stockholders”) of the Company of record as of March 8, 2017July 3, 2018 (the “Record Date”) on or about July [•], 2018.

Please follow the voting instructions on the enclosed proxy card and vote via the Internet on or about March 21, 2017. In addition, a Notice of Annual Meeting and a Notice of Internet Availability of Proxy Materials are being sent to Stockholders of record as of the Record Date.

Stockholders may provide their voting instructions through the Internet, by telephone or by mail by followingsigning, dating and returning the instructions onproxy card in the Notice ofpostage-paid envelope provided. Voting via the Internet Availability of Proxy Materials. These options requireor telephone requires Stockholders to input the control number, which is provided with the Notice of Internet Availability of Proxy Materials.enclosed proxy card. If you vote using the Internet, after visitingwww.proxyvote.com and inputting your control number, you will be prompted to provide your voting instructions. Stockholders will have an opportunity to review their voting instructions and make any necessary changes before submitting their voting instructions and terminating their Internet link. Stockholders that vote via the Internet, in addition to confirming their voting instructions prior to submission, will, upon request, receive an e-mail confirming their instructions.

If a Stockholder wishes to participate in the AnnualSpecial Meeting but does not wish to give a proxy by the Internet, the Stockholder may (1) attend the AnnualSpecial Meeting in person, or (2) request and submit a proxy card or (3) vote by telephone by following the instructions on the Notice of Internet Availability of Proxy Materials.enclosed proxy card.

Any proxy authorized pursuant to this solicitation may be revoked by the person giving the proxy at any time before it is exercised (1) by submitting new voting instructions via the Internet voting site, by telephone, by obtaining and properly completing another proxy card that is dated later than the original proxy card and returning it, by mail, in time to be received before the AnnualSpecial Meeting, (2) by attending the AnnualSpecial Meeting and voting in person or (3) by a notice, provided in writing and signed by the Stockholder, delivered to the Company’s Secretary on any business day before the date of the AnnualSpecial Meeting.

Purpose of the AnnualSpecial Meeting

At the AnnualSpecial Meeting, youStockholders of the Company will be asked to vote on the following proposals:

| 1. | To elect one Class II director of the Company who will serve until the 2020 annual meeting of stockholders or until his successor is duly elected and qualifies (“Proposal 1”); and |

| 2. | To approve a new investment advisory agreement (the “New Advisory Agreement”) between the Company and Garrison Capital Advisers LLC (“Garrison Capital Advisers” or the “Adviser”), the Company’s investment adviser (“Proposal 2”). |

proposal (the “Proposal”): to approve the application of the reduced asset coverage requirements in Section 61(a)(2) of the Investment Company Act of 1940, as amended (the “1940 Act”), to the Company.

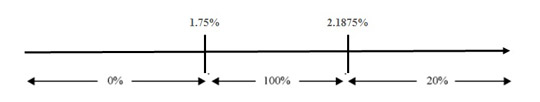

If the Proposal is approved by Stockholders, the Company and Garrison Capital Advisers LLC (the “Investment Adviser”) intend to reduce the base management fee payable under the fourth amended and restated investment advisory agreement between the Company and Garrison Capital Advisers (the “Investment Advisory Agreement”) from (a) an annual rate of 1.50% of the Company’s average gross assets, excluding cash or cash equivalents but including assets purchased with borrowed funds, at the end of each of the two most recently completed calendar quarters to (b) an annual rate of 1.50% of the Company’s average gross assets, excluding cash or cash equivalents but including assets purchased with borrowed funds, at the end of each of the two most recently completed calendar quarters; provided, however, the base management fee will be calculated at an annual rate of 1.00% of the average value of the Company’s gross assets, excluding cash or cash equivalents but including assets purchased with borrowed funds, that exceeds the product of (i) 200% and (ii) the Company’s average net assets at the end of each of the two most recently completed calendar quarters.

Voting Securities

You may vote your shares at the AnnualSpecial Meeting only if you were a Stockholder of record at the close of business on the Record Date. There were 16,049,352 shares of the Company’s common stock (the “Common Stock”) outstanding on the Record Date. Each share of Common Stock is entitled to one vote.

Quorum Required

A quorum must be present at the AnnualSpecial Meeting for any business to be conducted. The presence at the AnnualSpecial Meeting, in person or by proxy, of the holders of a majority of the shares of Common Stock outstanding on the Record Date will constitute a quorum. If there are not enough votes present for a quorum, the chairman of the AnnualSpecial Meeting will have the power to adjourn the AnnualSpecial Meeting to permit the further solicitation of proxies.

Abstentions.Abstentions will be treated as shares present for purposes of determining whether a quorum is present.

Broker Non-Votes.Shares held by a broker or other nominee for which the nominee has not received voting instructions from the beneficial owner and does not have discretionary authority to vote the shares on non-routine proposals (which are considered “broker non-votes” with respect to such proposals) will not be treated as shares present for purposes of determining whether a quorum is present.

Votes Required

Election of Directors

The election of a directorProposal requires the affirmative vote of a majority of the shares of Common Stockvotes cast at the AnnualSpecial Meeting in person or by proxy. Stockholders may not cumulate their votes.

Abstentions.With respect to approval of the Proposal, 1, abstentions will not be included in determining the number of votes cast and, as a result, will have no effect on the election of directors.Proposal.

Broker Non-Votes. The Proposal 1 is a non-routine matter. As a result, if you hold shares in “street name” through a broker, bank or other nominee, your broker, bank or nominee willnot be permitted to exercise voting discretion with respect to Proposal 1 at the Annual Meeting.Special Meeting and the shares will not be treated as present for quorum purposes. Therefore, if you do not vote and you do not give your broker or other nominee specific instructions on how to vote for you, then your broker cannot vote with respect to the Proposal 1.

Approval of the New Advisory Agreement

Approval of the New Advisory Agreement requires the affirmative vote of a “majority of the outstanding voting securities” of the Company. Under the Investment Company Act of 1940, as amended (the “1940 Act”), a “majority of the outstanding voting securities” means the affirmative vote of the lesser of (a) 67% or more ofand the shares of the Companywill not be treated as present or represented by proxy at the Annual Meeting if the holders of more than 50% of the outstanding shares are present or represented by proxy at the Annual Meeting, or (b) more than 50% of the outstanding shares. If Proposal 2 is approved by the Stockholders, the New Advisory Agreement is expected to become effective as of the date on which such approval is received. If Proposal 2 is not approved by the Stockholders, the current investment advisory agreement between the Company and the Adviser will continue in effect, and the Board will consider the various alternatives, including seeking subsequent approval of a new investment advisory agreement by the Stockholders.

Abstentions.With respect to approval of Proposal 2, abstentions will have the effect of a vote against the proposal.

Broker Non-Votes.Proposal 2 is a non-routine matter. As a result, if you hold shares in “street name” through a broker, bank or other nominee, your broker, bank or nominee willnot be permitted to exercise voting discretion with respect to Proposal 2 at the Annual Meeting. Therefore, if you do not vote and you do not give your broker or other nominee specific instructions on how to vote for you, then your broker cannot vote with respect to Proposal 2, which will have the effect of a vote against the proposal.quorum purposes.

Adjournment and Additional Solicitation

If there appears not to be enough votes to approve the proposalsProposal at the AnnualSpecial Meeting, the chairman of the AnnualSpecial Meeting will have the power to adjourn the AnnualSpecial Meeting to permit the further solicitation of proxies.

A Stockholder vote may be taken on Proposal 1 or Proposal 2 prior to any such adjournment if there are sufficient votes for approval of such proposal.

Appraisal Rights

Stockholders who vote against either proposalthe Proposal will not have appraisal or other similar rights with respect to such proposal.rights.

2

Information Regarding This Solicitation

The Company will bear the expense of the solicitation of proxies for the AnnualSpecial Meeting, including the cost of preparing and postingmailing this Proxy Statement and the Annual Report to the Internet and the cost of mailing the Notice of Annual Meeting, the Notice of Internet Availability of Proxy Materials and any requestedaccompanying proxy materials to Stockholders.card. The Company intends to use the services of Broadridge Financial Solutions, Inc., a leading provider of investor communications solutions, to aid in the distribution and collection of proxy votes. The Company expects to pay market rates for such services. The Company reimburses brokers, trustees, fiduciaries and other institutions for their reasonable expenses in forwarding proxy materials to the beneficial owners and soliciting them to execute proxies.

In addition to the solicitation of proxies by use of the Internet, proxies may be solicited in person and/or by telephone, mail or facsimile transmission by directors or officers of the Company, officers or employees of Garrison Capital Advisers LLC, Garrison Capital Administrator LLC, the Company’s administrator (“Garrison Capital Administrator”), and/or by a retained solicitor. No additional compensation will be paid to such directors, officers or regular employees for such services. If the Company retains a solicitor, the Company has estimated that it would pay approximately $10,000 for such services. If the Company engages a solicitor, you could be contacted by telephone on behalf of the Company and urged to vote. The solicitor will not attempt to influence how you vote your shares but will ask that you take the time to cast a vote. You may also be asked if you would like to vote over the telephone and to have your vote transmitted to ourthe Company’s proxy tabulation firm.

Security Ownership of Certain Beneficial Owners and Management

As of the Record Date, to ourthe Company’s knowledge, there are no persons who would be deemed to “control” us,the Company, as such term is defined in the 1940 Act.

The following table sets forth, as of the Record Date, certain ownership information with respect to ourthe Common Stock for those persons who directly or indirectly own, control or hold with the power to vote, five percent or more of ourthe Company’s outstanding Common Stock and all officers and directors, individually and as a group.

Name and address (1) | Type of ownership | Shares owned | Percentage of outstanding Common Stock | |

Corbin Capital Partners, L.P. and affiliates (2) | Record/Beneficial | 1,731,305 | 10.8 | % | |

Caxton Corporation (3) | Beneficial | 1,089,834 | 6.8 | % | |

RiverNorth Capital Management, LLC (4) | Beneficial | 1,060,624 | 6.6 | % | |

Joseph Tansey (5) | Record/Beneficial | 925,906 | 5.8 | % |

Brian Chase (6) | Record/Beneficial | 71,035 | | * |

Cecil Martin (7) | Record/Beneficial | 6,000 | | * |

Joseph Morea (8) | Beneficial | 4,500 | | * |

Matthew Westwood (9) | Record/Beneficial | 15,232 | | * |

All executive officers and directors as a group (5 persons) | Record/Beneficial | 1,022,673 | 6.4 | % |

___________

(1)

| | | | | Percentage of Common

Stock outstanding |

| Name and address(1) | | Type of ownership | | Shares owned | | Percentage |

| Joseph Tansey(2) | | | Record/Beneficial | | | | 867,906 | | | | 5.4 | % |

| Brian Chase(3) | | | Record/Beneficial | | | | 43,025 | | | | | * |

| Cecil Martin(4) | | | Record/Beneficial | | | | 3,000 | | | | | * |

| Joseph Morea(5) | | | Beneficial | | | | 2,000 | | | | | * |

| Matthew Westwood(6) | | | Record/Beneficial | | | | 14,450 | | | | | * |

| All executive officers and directors as a group (5 persons) | | | Record/Beneficial | | | | 930,381 | | | | 5.8 | % |

___________

(1) | The business address for each officer and director is c/o Garrison Investment Group, 1290 Avenue of the Americas, Suite 914, New York, New York 10104. | |

(2) | The address for Corbin Capital Partners, L.P. and its affiliates is 590 Madison Avenue, 31st Floor, New York, New York 10022. The number of shares beneficially owned is based on a Schedule 13G filed by Corbin Capital Partners, L.P. on January 31, 2018, which Schedule 13G reflects shared voting power over 1,731,305 shares by each of Corbin Capital Partners, L.P. and Corbin Capital Partners Group, LLC and shared voting power over 1,232,220 shares by Corbin Opportunity Fund, L.P. | |

(3) | Bruce S. Kovner is the Chairman and sole shareholder of Caxton Corporation, and as such beneficially owns the 1,089,834 shares owned by Caxton Corporation. The address for Caxton Corporation and Bruce S. Kovner is 731 Alexander Road, Bldg. 2, Suite 500, Princeton, New Jersey 08540. The number of shares beneficially owned by Caxton Corporation is based on a Schedule 13G filed by Caxton Corporation on February 14, 2018, which Schedule 13G reflects shared voting power over 1,089,834 shares by each of Caxton Corporation and Bruce S. Kovner. | |

3

(4) | The address for RiverNorth Capital Management, LLC is 325 N. LaSalle Street, Suite 645, Chicago, Illinois 60654-7030. The number of shares beneficially owned by RiverNorth Capital Management, LLC is based on a Schedule 13G filed by RiverNorth Capital Management, LLC on February 14, 2018, which Schedule 13G reflects sole voting power over 1,060,624 shares by RiverNorth Capital Management, LLC. | |

(5) | Mr. Tansey is a control person of Garrison Investment Group and its affiliates. The shares of Common Stock shown in the above table as being owned by him reflect the fact that, due to his control of such entities, he may be viewed as having investment power over the 266,931 and 455,777 shares of Common Stock owned of record by Garrison Capital Fairchild I Ltd. and Garrison Capital Fairchild II Ltd., respectively. In each case, all of the voting rights to such shares have been passed through to the ultimate limited partners or members, as the case may be. In addition, the shares of Common Stock shown in the above table as being owned by Mr. Tansey reflect the fact that, due to his control of such entities, he may be viewed as having investment and voting power over an aggregate of 67,202 shares owned of record by Garrison Capital Advisers Holdings MM LLC. Mr. Tansey additionally owns 77,996135,996 shares directly. Mr. Tansey owns 2.2%2.1% of these shares of record and 100% of these shares beneficially. | |

(3)(6) | Mr. Chase owns 9.9%4.2% of these shares of record and 100% of these shares beneficially. | |

(4)(7) | Mr. Martin owns 100% of these shares beneficially and of record. | |

(5) | Mr. Morea owns 100% of these shares beneficially. | |

(6) | Mr. Westwood owns 30.8%5.0% of these shares of record and 100% of these shares beneficially. | |

*(8) | Mr. Morea owns 100% of these shares beneficially. | |

(9) | Mr. Westwood owns 34.3% of these shares of record and 100% of these shares beneficially. | |

* | Less than 1 percent. |

Section 16(a) Beneficial Ownership Reporting Compliance

Pursuant to Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company’s directors and other executive officers and any persons holding more than 10% of its Common Stock are required to report their beneficial ownership and any changes therein to the SEC and the Company. Specific due dates for those reports have been established, and the Company is required to report in this Proxy Statement any failure to file such reports by those due dates. Based on a review of Forms 3, 4 and 5 filed by directors, other executive officers and any person holding more than 10% of the Common Stock and other information provided to the Company, the Company believes that during the year ended December 31, 2016, no such person failed to file such reports by their specific due dates.

Dollar Range of Equity Securities Beneficially Owned by Directors

The following table sets forth the dollar range of ourthe Company’s equity securities beneficially owned by each of our directorsdirector as of the Record Date. We areThe Company is not part of a “family of investment companies,” as that term is defined in Schedule 14A.

Name of Director | | | Dollar Range of

Equity Securities in

the Company(1) | |

Independent Directors | | | | |

Cecil Martin | | | $10,001 – $50,000 | |

Joseph Morea | | | $10,001 – $50,000 | |

Matthew Westwood | | | Over $100,000 | |

Interested Directors | | | | |

Joseph Tansey | | | Over $100,000 | |

Brian Chase | | | Over $100,000 | |

___________

| (1) | Dollar ranges are as follows: None; $1 – $10,000; $10,001 – $50,000; $50,001 – $100,000; over $100,000. |

PROPOSAL 1: ELECTION OF DIRECTORS

In accordance with the Company’s bylaws, the Board currently has five members. Two of these members are interested directors and three are independent directors. An interested director is an “interested person” of the Company, as defined in the 1940 Act, and independent directors are all other directors (the “Independent Directors”). Messrs. Cecil Martin, Joseph Morea and Matthew Westwood qualify as Independent Directors.

Directors are divided into three classes and are elected for staggered terms, with a term of office of one of the three classes of directors expiring each year. After this election, the terms of Class I, II and III will expire in 2019, 2020 and 2018, respectively. Each director will hold office for the term to which he is elected or until his successor is duly elected and qualifies.

A Stockholder can vote for or against, or abstain from voting with respect to, any nominee. In the absence of instructions to the contrary, it is the intention of Joseph Tansey and Brian Chase, the persons named as proxies, to vote such proxy FOR the election of each nominee named below. If a nominee should decline or be unable to serve as a director, it is intended that the proxy will be voted for the election of such person as is nominated by the Board as a replacement. The Board has no reason to believe that the nominee will be unable or unwilling to serve.

If the nominee is not elected by the Stockholders at the Annual Meeting, in accordance with the Company’s Certificate of Incorporation, the nominee will continue to serve as a director until his successor is elected and qualifies or until his earlier resignation, removal from office, death or incapacity.

THE BOARD, INCLUDING EACH OF ITS INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT YOU VOTEFOR THE ELECTION OF THE NOMINEE NAMED IN THIS PROXY STATEMENT.

Information about the Nominee and Directors

Certain information with respect to the Class II nominee for election at the Annual Meeting, as well as each of the other directors, is set forth below, including their names, ages, a brief description of their recent business experience, including present occupations and employment, certain directorships that each person holds and the year in which each person became a director of the Company. The nominee for Class II director currently serves as a director of the Company.

Mr. Westwood has been nominated for election as a Class II director for a term expiring at the 2020 annual meeting of stockholders. Mr. Westwood is not being proposed for election pursuant to any agreement or understanding between Mr. Westwood and the Company.

Nominee for Class II Director

Name, Age and Address(1) | | Position(s) Held with the Company | | | Director Since | | | Expiration of Term | | Principal Occupation(s) During the Past Five Years | | Other Directorships Held by

Director or Nominee for

Director During the Past

Five Years(2) |

Independent Director | | | | | | | | | | | | |

Matthew Westwood (46) | | Director | | | 2011 | | | 2017 (2020 if reelected) | | Retired | | None |

Class I Directors (continuing directors not up for re-election at the Annual Meeting)

| Name, Age and Address(1) | | Position(s) Held

with the Company | | | Director

Since | | | | Expiration

of Term | | | Principal Occupation(s)

During the Past

Five Years | | Other Directorships Held by

Director or Nominee for

Director During the Past

Five Years(2) |

| Interested Director | | | | | | | | | | | | | | |

| Joseph Tansey (44)(3) | | Chairman of the Board and Chief Executive Officer | | | 2011 | | | | 2019 | | | President — Garrison Investment Group (March 2007 – present) | | None |

| Independent Director | | | | | | | | | | | | | | |

| Cecil Martin (75) | | Director | | | 2011 | | | | 2019 | | | Independent Commercial Real Estate Investor | | Director — Comstock Resources, Inc.

(1988 – present) |

| | | | | | | | | | | | | | | Director — Crosstex Energy, Inc. (2006 –2014) |

| | | | | | | | | | | | | | | Director — Crosstex Energy, L.P. (2006 – 2014) |

Class III Directors (continuing directors not up for re-election at the Annual Meeting)

| Name, Age and Address(1) | | Position(s) Held with the Company | | | Director Since | | | | Expiration of Term | | | Principal Occupation(s) During the Past Five Years | | Other Directorships Held by

Director or Nominee for

Director During the Past

Five Years(2) |

| Interested Director | | | | | | | | | | | | | | |

| Brian Chase (39)(4) | | Chief Financial Officer, Treasurer and Director | | | 2011 | | | | 2018 | | | Chief Operating Officer and Chief Financial Officer —

Garrison Investment Group (March 2007 – present) | | None |

| Independent Director | | | | | | | | | | | | | | |

| Joseph Morea (61) | | Director | | | 2015 | | | | 2018 | | | Principal – Berkeley Realty Ventures LLC (August 2012 – present)

Vice Chairman and Managing Director – RBC Capital Markets (2003 – June 2012) | | Director – RMR Real Estate Income Fund (May 2016 – present) Trustee – Eagle Growth and Income Opportunities Fund (April 2015 – present) Director – TravelCenters of America LLC (February 2015 – present) Trustee– THL Credit Senior Loan Fund (June 2013 – present) Trustee – Equity Commonwealth (formerly known as CommonWealth REIT) (July 2012 – March 2014) |

___________

(1) | The business address of each director and nominee is c/o Garrison Investment Group, 1290 Avenue of the Americas, Suite 914, New York, New York 10104. |

(2) | With the exception of Mr. Martin and Mr. Morea, as disclosed herein, no director otherwise currently serves, or has served during the past five years, as a director of a company with a class of securities registered pursuant to Section 12 or subject to the requirements of Section 15(d) of the Exchange Act or an investment company registered under the 1940 Act. |

(3) | Mr. Tansey is an interested director due to his position as Chief Executive Officer of the Company and as President of Garrison Investment Group. |

(4) | Mr. Chase is an interested director due to his position as Chief Financial Officer and Treasurer of the Company and Chief Operating Officer and Chief Financial Officer of Garrison Investment Group. |

Corporate Governance

We believe that maintaining the highest standards of corporate governance is a crucial part of our business, and we are committed to having in place the necessary controls and procedures designed to ensure compliance with applicable laws, rules and regulations.

Director Independence

The NASDAQ Global Select Market (“NASDAQ”) corporate governance requirements require listed companies to have a board of directors with at least a majority of Independent Directors. Under NASDAQ corporate governance requirements, in order for a director to be deemed independent, the Board must determine that the individual does not have a relationship that would interfere with the director’s exercise of independent judgment in carrying out his responsibilities. On an annual basis, each of our directors is required to complete a questionnaire designed to provide information to assist the Board in determining whether the director is independent under NASDAQ corporate governance requirements, the 1940 Act and our corporate governance guidelines. The Board has determined that each of Messrs. Martin, Morea and Westwood is independent under the NASDAQ corporate governance requirements and the 1940 Act. Our corporate governance guidelines require any director who has previously been determined to be independent to inform the Chairman of the Board, the Chairman of the Nominating and Corporate Governance Committee and our Secretary of any change in circumstance that may cause his status as an Independent Director to change. The Board limits membership on the Audit Committee, the Nominating and Corporate Governance Committee, the Compensation Committee and the Valuation Committee to Independent Directors.

The Board’s Oversight Role in Management

The Board’s role in management of the Company is one of oversight. Oversight of the Company’s investment activities extends to oversight of the risk management processes employed by Garrison Capital Advisers as part of its day-to-day management of our investment activities. The Board reviews risk management processes at both regular and special Board meetings throughout the year, consulting with appropriate representatives of Garrison Capital Advisers as necessary and periodically requesting the production of risk management reports or presentations. The goal of the Board’s risk oversight function is to ensure that the risks associated with our investment activities are accurately identified, thoroughly investigated and responsibly addressed. Stockholders should note, however, that the Board’s oversight function cannot eliminate all risks or ensure that particular events do not adversely affect the value of the Company’s investments.

The Board’s Composition and Leadership Structure

The 1940 Act and NASDAQ corporate governance requirements require that at least a majority of the Company’s directors not be “interested persons” (as defined in the 1940 Act) of the Company. Currently, three of the Company’s five directors are Independent Directors (and are not “interested persons”). Joseph Tansey, President of Garrison Investment Group, Chairman of the Board and our Chief Executive Officer is an interested person of the Company. The Board believes that it is in the best interests of our investors for Mr. Tansey to lead the Board because of his familiarity with our portfolio companies, his broad experience with the day-to-day management and operation of other investment funds and his significant background in the financial services industry, as described below.

The Board does not have a lead Independent Director. However, Mr. Martin, the Chairman of the Audit Committee, Mr. Morea, the Chairman of the Nominating and Corporate Governance Committee, and Mr. Westwood, the Chairman of the Valuation Committee, are Independent Directors and act as liaisons between the Independent Directors and management between meetings of the Board. The Board believes that its leadership structure is appropriate because the structure allocates areas of responsibility among the individual directors and the committees in a manner that enhances effective oversight. The Board also believes that its small size creates an efficient corporate governance structure that provides opportunity for direct communication and interaction between Garrison Capital Advisers and the Board.

Information About Each Director’s Experience, Qualifications, Attributes or Skills

Below is additional information about each director (supplementing the information provided in the table above) that describes some of the specific experiences, qualifications, attributes and/or skills that each director possesses and which the Board believes has prepared each director to be an effective member of the Board. The Board believes that the significance of each director’s experience, qualifications, attributes and/or skills is an individual matter (meaning that experience or a factor that is important for one director may not have the same value for another) and that these factors are best evaluated at the Board level, with no single director, or particular factor, being indicative of Board effectiveness. However, the Board believes that directors need to have the ability to review, evaluate, question and discuss critical information provided to them and to interact effectively with Company management, service providers and counsel, in order to exercise effective business judgment in the performance of their duties. The Board believes that its members satisfy this standard. Experience relevant to having this ability may be achieved through a director’s professional experience, education and/or other personal experiences. The Company’s counsel has significant experience advising funds and fund board members. The Board and its committees have the ability to engage other experts as appropriate. The Board evaluates its performance on an annual basis.

Experience, Qualifications, Attributes and/or Skills that Led to the Board’s Conclusion that such Members Should Serve as Directors of the Company

The Board believes that, collectively, the directors have balanced and diverse experience, qualifications, attributes and skills, which allow the Board to operate effectively in governing the Company and protecting the interests of the Stockholders. Below is a description of the various experiences, qualifications, attributes and/or skills with respect to each director considered by the Board.

Interested Directors

|

| | | Joseph Tansey has served | | | Over $100,000 | |

Brian Chase | | | Over $100,000 | |

___________

| | |

| (1) | Dollar ranges are as Chairmanfollows: None; $1 – $10,000; $10,001 – $50,000; $50,001 – $100,000; over $100,000. |

4

PROPOSAL — APPROVAL OF APPLICATION OF REDUCED ASSET COVERAGE REQUIREMENTS TO THE COMPANY

The Company is a closed-end management investment company that has elected to be regulated as a BDC under the 1940 Act. The 1940 Act contains asset coverage requirements which limit the ability of BDCs to incur leverage, and a BDC is generally only allowed to borrow amounts by issuing debt securities or preferred stock (collectively referred to as “senior securities”) if its asset coverage, as defined in the 1940 Act, equals at least 200% after such borrowing. For purposes of the 1940 Act, “asset coverage” means the ratio of (1) the total assets of a BDC, less all liabilities and indebtedness not represented by senior securities, to (2) the aggregate amount of senior securities representing indebtedness (plus, in the case of senior securities represented by preferred stock, the aggregate involuntary liquidation preference of such preferred stock). The Company has received exemptive relief from the SEC to exclude from its asset coverage ratio the debentures of any small business investment company (“SBIC”) subsidiary.

On March 23, 2018, the Small Business Credit Availability Act (the “SBCAA”) was enacted into law. The SBCAA, among other things, amended Section 61(a) of the 1940 Act to add a new Section 61(a)(2) that reduces the asset coverage requirements applicable to BDCs from 200% to 150%, which permits a BDC to increase the maximum amount of leverage that it is permitted to incur, so long as the BDC meets certain disclosure requirements and obtains certain approvals. Under these modified asset coverage requirements, a BDC will be able to incur additional leverage, as the asset coverage requirements for senior securities (leverage) applicable to the Company pursuant to Sections 18 and 61 of the 1940 Act will be reduced to 150% (equivalent to a 66-2/3% debt-to-total capital ratio) from 200% (equivalent to a 50% debt-to-total capital ratio). Effectiveness of the reduced asset coverage requirement to a BDC requires approval by either (1) a “required majority,” as defined in Section 57(o) of the 1940 Act, of such BDC’s board of directors with effectiveness one year after the date of such approval or (2) a majority of votes cast at a special or annual meeting of such BDC’s stockholders at which a quorum is present, which can be effective as soon as the day after such stockholder approval.

At a meeting of the Board held on March 28, 2018, the Board, including a “required majority” of the Company’s directors, as defined in Section 57(o) of the 1940 Act, approved the application of the reduced asset coverage requirements in Section 61(a)(2) of the 1940 Act as being in the best interests of the Company and Stockholders, and, as a result, and subject to certain additional disclosure requirements as described below and provided such approval is not later rescinded, the reduced asset coverage requirements will apply to the Company effective as of March 28, 2019 (unless earlier approved at the Special Meeting).

In addition, the Board has determined that it is advisable and in the best interest of the Company and Stockholders that the reduced asset coverage requirements for senior securities in Section 61(a)(2) of the 1940 Act apply to the Company as soon as practicable. Therefore, the Board has decided to hold the Special Meeting to seek approval from Stockholders of the Proposal in an effort to accelerate the effectiveness of the reduced asset coverage requirements. If the Proposal is approved by Stockholders at the Special Meeting, the asset coverage required for the Company’s senior securities will be 150% rather than 200% commencing on the first day after such approval. If the Proposal is not approved by Stockholders, the Company currently intends to continue to operate within the 200% asset coverage requirements in accordance with its current investment strategy until March 28, 2019.

Recommendation and Rationale

The Board unanimously recommends that Stockholders vote in favor of the Proposal and the application of the reduced asset coverage requirements in Section 61(a)(2) of the 1940 Act to the Company. In reaching its decision to recommend the Proposal, the Board, including all of the independent directors, considered the following factors related to the Proposal:

the Company’s investment strategy and focus on first lien senior secured loans;

the additional flexibility to manage the Company’s capital to seek to take advantage of attractive investment opportunities;

the potential impact (both positive and negative) on net investment income, return to Stockholders and net asset value;

5

| • | the Board and Chief Executive Officer since 2011 and is a member of our investment committee. He has served as President of Garrison Investment Group since its formation in March 2007. Prioradditional flexibility to forming Garrison Investment Group, Mr. Tansey was a managing director at Fortress Investment Group LLC from 2002make distributions required to 2007 and a partner of Drawbridge Special Opportunities Fund from its inception in August 2002 to March 2007. At Drawbridge Special Opportunities Fund, Mr. Tansey was responsible for investment and loan structuring with a focus on structured finance and real estate transactions. Most recently, he ran Drawbridge Special Opportunities Fund’s rediscount lending business. From 1998 to 2002, Mr. Tansey worked at Goldman Sachs & Co. in Tokyo, Hong Kong and New Yorkmaintain the Company’s tax status as a memberregulated investment company without violating the 1940 Act; |

the impact on fees payable by the Company to Garrison Capital Advisers; and

the other considerations noted below.

Investment strategy and focus on first lien senior secured loans

The Board noted that the Company primarily invests in first lien senior secured loans. As of March 31, 2018 and December 31, 2017, 97.2% and 98.2%, respectively, of the Company’s portfolio at fair value consisted of first lien senior secured loans. The Board observed that a portfolio primarily comprised of senior debt investments would be well-positioned to incur additional leverage and that because of the Company’s exemptive relief with respect to SBIC debentures, as of March 31, 2018, the Company’s asset coverage was 178% as computed under generally accepted accounting principles as compared to 204% as computed under the 1940 Act.

Flexibility to manage the Company’s capital to seek to take advantage of attractive investment opportunities

The Company believes that attractive investment opportunities can arise throughout credit and economic cycles and that it intends to deploy capital with a focus on long-term results. However, neither the Company nor Garrison Capital Advisers can predict when attractive opportunities may arise and such opportunities may arise at a time when (i) it may be disadvantageous, (ii) the Company is unable to raise additional equity due to the 1940 Act limitations on the issuance of Common Stock at prices below net asset value per share absent stockholder approval (which the Company does not currently have) or (iii) market conditions are not attractive for raising equity capital. The Board noted that if the Company is not able to (or chooses not to) access additional capital when attractive investment opportunities arise, its ability to continue to pay regular distributions to Stockholders could be adversely affected. Based on the Company’s balance sheet as of March 31, 2018, reducing the asset coverage requirements applicable to the Company to 150% would permit the Company to borrow up to approximately $185.2 million in additional capital. The ability to access this additional capital would provide enhanced flexibility to take advantage of attractive investment opportunities as they arise. The Board discussed various types of debt financing and noted that debt securitizations, were they to continue to be used by the Company, can provide advantages over other types of financing structures, such as a lower borrowing cost and a longer period during which the Company’s collateralized loan obligation subsidiary can continue to use principal proceeds from existing loans to purchase new loans. Furthermore, the Board discussed that there could be no assurance that the Company would be able to obtain additional leverage from lenders on favorable terms, or at all.

In addition, the Board noted that any increase in total assets available for investment would increase the assets available for investment in assets that are “non-qualifying assets” for purposes of Section 55 of the 1940 Act, thereby further increasing the likelihood that the Company could take advantage of attractive investment opportunities.

Potential impact on net investment income, return to Stockholders and net asset value

The Board considered the impact of additional leverage on the Company’s net investment income, noting that additional leverage could increase net investment income. Management finally noted that additional leverage would magnify increases in the Company’s income, if any, which could cause the Company’s net investment income to exceed the quarterly hurdle rate for the incentive fee the Company pays to Garrison Capital Advisers with comparatively lower absolute returns on the Company’s investments but that the cap and deferral mechanism would provide some protection against incentive fees being paid where the Company’s net assets decline. The Board also discussed that additional leverage could cause the Company’s net investment income to decline more sharply if the Company’s portfolio had more non-performing assets than it otherwise would have if the Company did not employ such additional leverage, for example, if spreads were to narrow or interest rates on the Company’s borrowings increased. In addition, any additional leverage incurred by the Company would increase its expenses, including interest expense or dividends and potential fees and costs related to entering into new debt securitizations or credit facilities. Increased expenses when combined with any decrease in the Company’s income would cause net income to decline more sharply than it would have had the Company not incurred additional leverage, which could negatively affect the Company’s ability to make Common Stock distributions or debt payments.

6

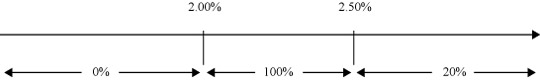

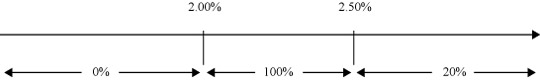

The following table is intended to assist stockholders in understanding the effect of leverage on returns from an investment in the Common Stock assuming that the Company employs leverage such that its asset coverage equals (1) the Company’s actual asset coverage as of March 31, 2018 (204%), (2) 200% (excluding the Company’s SBIC debentures as permitted by the Company’s exemptive relief) and (3) 150% at various annual returns, net of expenses, as of March 31, 2018. The assumed returns on the Company’s portfolio are required by regulation to assist investors in understanding the effects of leverage and is not a prediction of, and does not represent, the Company’s projected or actual performance. The calculations in the table below are hypothetical and actual returns may be higher or lower than those appearing in the table below.

| | | | | |

Assumed Return on Portfolio (Net of Expenses) | -10.00% | -5.00% | 0.00% | 5.00% | 10.00% |

Corresponding net return to Stockholders assuming actual asset coverage as of March 31, 2018 (204% asset coverage)(1) | -28.66% | -17.25% | -5.83% | 5.58% | 17.00% |

Corresponding return to Stockholders assuming 200% asset coverage(2) | -29.40% | -17.69% | -5.99% | 5.71% | 17.42% |

Corresponding return to Stockholders assuming 150% asset coverage(3) | -43.76% | -27.06% | -10.36% | 6.35% | 23.05% |

___________

(1) | Assumes $427.0 million in total assets, $238.7 million of debt outstanding (including the Asian Special Situations Group, the Real Estate Principal Investment GroupCompany’s SBIC debentures), $185.2 million in net assets as of March 31, 2018 and the Mortgages Department. Prior to joining Goldman Sachs, Mr. Tansey worked at Starwood Capital Group from 1995 to 1998 where he was involved in the acquisition and management of real estate operating businesses and distressed debt. Mr. Tansey received a B.A. and a B.S. from The University of Pennsylvania. Mr. Tansey’s experiences with Garrison Investment Group and several other investment groups and his focus on middle-market lending and structured finance led our Nominating and Corporate Governance Committee to conclude that Mr. Tansey is qualified to serve as a director.

Brian Chase has served as our Chief Financial Officer, Treasurer and director since 2011 and is a member of our investment committee. He joined Garrison Investment Group at its formation in March 2007 and currently serves as its chief operating officer and chief financial officer with responsibility for structuringan average cost of funds financing, operations, tax, accounting and general administration. Prior to joining Garrison Investment Group, from 2005 until March 2007, Mr. Chase was chief financial officer of 4.52%, which is the Distressed Securities business at The Blackstone Group, where he was responsible for building and overseeing the fund infrastructure and operations. From 2002 until 2005, Mr. Chase was a controller for Fortress Investment Group LLC where he helped develop and oversee the fund’s accounting, tax, financing and operations. Prior to joining Fortress Investment Group, Mr. Chase worked at UBS Alternative Investment Group, a manager of equity and distressed hedge funds, and in the Capital Markets Group at PricewaterhouseCoopers LLP specializing in hedge fund audits. Mr. Chase received a B.S. from the State University of New York at Binghamton and is a Certified Public Accountant (inactive). Mr. Chase’s experiences with Garrison Investment Group and several other investment groups and his focus on the middle market led our Nominating and Corporate Governance Committee to conclude that Mr. Chase is qualified to serve as a director.

Independent Directors

Cecil Martin has served as a director since 2011. Mr. Martin is an independent commercial real estate investor. Mr. Martin has served as a director of Comstock Resources, Inc. since 1988 and currently serves as its lead independent director and chairman of its audit committee. From 2006 until March 2014, he served on the board of directors of Crosstex Energy, Inc. and Crosstex Energy, L.P. and was a member of the audit committee, the risk management committee and the compensation committee of Crosstex Energy, L.P. and Crosstex Energy, Inc. Mr. Martin also served as chair of the compensation committee of Crosstex Energy, L.P. From 2006 through 2008, Mr. Martin was a director and chairman of the audit committee of Bois d’Arc Energy, Inc. In addition, from 1973 to 1991, he served as chairman of a public accounting firm in Richmond, Virginia. Mr. Martin received a B.B.A. from Old Dominion University and is a Certified Public Accountant in the Commonwealth of Virginia. Mr. Martin’s experience as an accountant and past and ongoing service as a director of public companies led our Nominating and Corporate Governance Committee to conclude that Mr. Martin is qualified to serve as a director.

Joseph Morea has served as a director since 2015. Mr. Morea is currently a Principal for Berkeley Realty Ventures, LLC, a position he has held since August 2012. Mr. Morea has also served as a director for RMR Real Estate Income Fund, an investment company primarily investing in common and preferred securities issued by REITs and other real estate companies, since May 2016, Eagle Growth and Income Opportunities Fund, an investment company of FourWood Capital Advisors, LLC primarily investing in equity and fixed income securities, since April 2015, for TravelCenters of America LLC, a company that operates full-service facilities along highways, since February 2015 and for THL Credit Senior Loan Fund, an investment company of FourWood Capital Advisors, LLC primarily investing in bank loans, since June 2013. Additionally, he served as a director for Equity Commonwealth, a real estate investment trust, from July 2012 to March 2014. Prior to joining Berkeley Realty Ventures, Mr. Morea served as the Vice Chairman and Managing Director of RBC Capital Markets from 2003 through June 2012. In this position, Mr. Morea led the U.S. Equity Capital Markets Division, the U.S. Investment Banking Division and the U.S. Commitment Committee. Earlier in his career, Mr. Morea held positions in equity capital markets at UBS, Inc., PaineWebber, Inc. and Smith Barney, Inc. and was a branch manager at Merrill Lynch Pierce Fenner & Smith, Inc. Mr. Morea received a B.S. from Albany State University and a M.B.A. from The Peter J. Tobin College of Business at St. John’s University. Mr. Morea is also a Certified Public Accountant. Mr. Morea’s extensive knowledge of capital markets and his experience as a director with other investment companies led the Nominating and Corporate Governance Committee to conclude that Mr. Morea is qualified to serve as a director.

Matthew Westwood has served as a director since 2011. Mr. Westwood most recently served as the managing director and principal of Wilshire Associates Incorporated from 1997 to 2010. While at Wilshire Associates Incorporated, Mr. Westwood was also a senior investment professional for Wilshire Private Markets, a global private equity fund of funds. At Wilshire Private Markets, Mr. Westwood focused on private equity partnership investments, co-investments and secondary investments with responsibility for investment strategy, market research, portfolio construction, investment sourcing, due diligence and interfacing with institutional clients and consultants. Prior to joining Wilshire Associates Incorporated, Mr. Westwood worked at Ernst & Young LLP from 1992 to 1996 where he managed audit and consulting engagements for both public and private clients. During his career, Mr. Westwood has served on numerous private equity limited partner advisory boards, including serving as a member of the board of directors of the Pittsburgh Venture Capital Association from July 2004 to June 2006 and as a member of the board of directors of Wilshire Associates Incorporated’s 401k Committee from December 2006 to March 2010. Mr. Westwood received a B.S. from Villanova University and an M.B.A. from the University of Pittsburgh. Mr. Westwood is currently an inactive Certified Public Accountant. Mr. Westwood’s experience at a senior level in the asset management industry and as an accountant led our Nominating and Corporate Governance Committee to conclude that Mr. Westwood is qualified to serve as a director.

Committees of the Board

The Board has established an Audit Committee, Nominating and Corporate Governance Committee, Valuation Committee and Compensation Committee. For the fiscal year ended December 31, 2016, the Board held four meetings, the Valuation Committee held seven meetings, the Audit Committee held four meetings and the Nominating and Corporate Governance Committee and the Compensation Committee each held one meeting. During the fiscal year ended December 31, 2016, all directors attended 75% or more of the aggregate number of meetings of the Board and all committees of the Board on which they served that were held while they were members of the Board. The Company requires each director to make a diligent effort to attend all Board and committee meetings and encourages directors to attend the Annual Meeting. Each of the seven then-serving directors attended the 2016 annual meeting of stockholders.

Audit Committee

The members of the Audit Committee are Messrs. Martin, Morea and Westwood, each of whom is independent for purposes of the 1940 Act and the NASDAQ corporate governance requirements. Mr. Martin serves as Chairman of the Audit Committee. The Audit Committee is responsible for approving our independent accountants, reviewing with our independent accountants the plans and results of the audit engagement, approving professional services provided by our independent accountants, reviewing the independence of our independent accountants and reviewing the adequacy of our internal accounting controls. The Board has determined that Mr. Martin is an “audit committee financial expert,” as defined in Item 407(d)(5) of Regulation S-K. In addition, each member of our Audit Committee meets the current independence and experience requirements of Rule 10A-3 under the Exchange Act. The Audit Committee has adopted a written charter that is available on our website atwww.garrisoncapitalbdc.com.

Nominating and Corporate Governance Committee

The members of the Nominating and Corporate Governance Committee are Messrs. Martin, Morea and Westwood, each of whom is independent for purposes of the 1940 Act and the NASDAQ corporate governance requirements. Mr. Morea serves as Chairman of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for selecting, researching and nominating directors for election by our Stockholders, selecting nominees to fill vacancies on the Board or a committee of the Board, developing and recommending to the Board a set of corporate governance principles and overseeing the evaluation of the Board and our management. The Nominating and Corporate Governance Committee has adopted a written charter that is available on our website atwww.garrisoncapitalbdc.com.

The Nominating and Corporate Governance Committee will consider nominees to the Board recommended by a Stockholder if such Stockholder complies with the advance notice provisions of our bylaws. Our bylaws provide that a Stockholder who wishes to nominate a person for election as a director at a meeting of Stockholders must deliver written notice to our Secretary, Garrison Capital Inc., c/o Michael L. Butler, 1290 Avenue of the Americas, Suite 914, New York, New York 10104. This notice must contain, as to each nominee, all of the information relating to such person as would be required to be disclosed in a proxy statement meeting the requirements of Regulation 14A under the Exchange Act, and certain other information set forth in the bylaws, including the following information for each director nominee: full name, age, business address and residence address; principal occupation or employment during the past five years; directorships on publicly held companies and investment companies during the past five years; number of shares of our Common Stock owned, if any; and a written consent of the individual to stand for election if nominated by the Board and to serve if elected by the Stockholders. In order to be eligible to be a nominee for election as a director by a Stockholder, such potential nominee must deliver to our Secretary a written questionnaire providing the requested information about the background and qualifications of such person and a written representation and agreement that such person is not and will not become a party to any voting agreements, any agreement or understanding with any person with respect to any compensation or indemnification in connection with service on the Board and would be in compliance with all of our publicly disclosed corporate governance, conflict ofweighted average effective interest confidentiality and stock ownership and trading policies and guidelines.

Criteria considered by the Nominating and Corporate Governance Committee in evaluating the qualifications of individuals for election as members of the Board include compliance with the independence and other applicable requirements of the NASDSAQ corporate governance requirements, the 1940 Act and the SEC, and all other applicable laws, rules, regulations and listing standards, the criteria, policies and principles set forth in the Nominating and Corporate Governance Committee charter and the ability to contribute to the effective management of the Company, taking into account the needs of the Company and such factors as the individual’s experience, perspective, skills and knowledge of the industry in which the Company operates. The Nominating and Corporate Governance Committee has not adopted a formal policy with regard to the consideration of diversity in identifying individuals for election as members of the Board, but the Nominating and Corporate Governance Committee will consider such factors as it may deem are in the best interests of the Company and its Stockholders. Such factors may include the individual’s professional experience, education, skills and other individual qualities or attributes, including gender, race or national origin.

Valuation Committee

The members of our Valuation Committee are Messrs. Martin, Morea and Westwood, each of whom is independent for purposes of the 1940 Act and the NASDAQ corporate governance requirements. Mr. Westwood serves as Chairman of the Valuation Committee. The Valuation Committee is responsible for making recommendations to the Board in accordance with the valuation policies and procedures adopted by the Board (the “Valuation Policies”), reviewing valuations and any reports of independent valuation firms, confirming valuations are made in accordance with the Valuation Policies and reporting any deficiencies or violations of such valuation procedures to the Board on at least a quarterly basis and reviewing such other matters as the Board or the Valuation Committee shall deem appropriate. The Valuation Committee uses the services of one or more independent valuation firms to help them determine the fair value of securities. The Valuation Committee has adopted a written charter that is available on our website atwww.garrisoncapitalbdc.com.

Compensation Committee

The members of our Compensation Committee are Messrs. Martin, Morea and Westwood, each of whom is independent for purposes of the 1940 Act and the NASDAQ corporate governance requirements. The Compensation Committee is responsible for determining, or recommending to the Board for determination, the compensation, if any, of our chief executive officer and all other executive officers of the Company. Currently nonerate of the Company’s executive officers is compensated bydebt for the Companythree months ended March 31, 2018, and as a result,includes the Compensation Committee does not produce and/or review a report on executive compensation practices. The Compensation Committee has the authority to engage compensation consultants following consideration of certain factors related to such consultants’ independence. The Compensation Committee has adopted a written charter that is available on our website atwww.garrisoncapitalbdc.com.

Compensation Committee Interlocks and Insider Participation

Messrs. Martin, Morea and Westwood, as well as Mr. Bruce Shewmaker, served as memberseffects of the Compensation Committee duringamortization of deferred debt issuance costs.

|

(2) | Assumes $433.5 million in total assets, $245.2 million of total debt outstanding (including the year ended DecemberCompany’s SBIC debentures), $185.2 million in net assets as of March 31, 2016. None2018 and an average cost of funds of 4.52%, which is the weighted average effective interest rate of the relationships described in Item 407(e)(4)(iii) of Regulation S-K existed with respect toCompany’s debt for the Company duringthree months ended March 31, 2018, and includes the year ended December 31, 2016. Communication with the Board

Stockholders with questions about the Company are encouraged to contact the Company by writing to Investor Relations Department, Garrison Capital Inc., 1290 Avenueeffects of the Americas, Suite 914, New York, New York 10104, by calling us collect at (212) 372-9590 or by visiting our website atwww.garrisoncapitalbdc.com. However, if Stockholders believe that their questions have not been addressed, they may communicate withamortization of deferred debt issuance costs.

|

(3) | Assumes $618.7 million in total assets, $423.9 million of total debt outstanding (including the Board by sending their communications to Secretary, Garrison Capital Inc.Company’s SBIC debentures), c/o Michael L. Butler, 1290 Avenue$185.2 million in net assets as of March 31, 2018 and an average cost of funds of 4.52%, which is the weighted average effective interest rate of the Americas, Suite 914, New York, New York 10104. All Stockholder communications received in this manner will be delivered to one or more membersCompany’s debt for the three months ended March 31, 2018, and includes the effects of the Board.amortization of deferred debt issuance costs. Information about the Officer who is not a Director

Set forth below is certain information regarding our officer who is not a director.

|

Based on the Company’s outstanding indebtedness of $238.7 million as of March 31, 2018 and an average cost of funds of 4.52% as of that date, the Company’s investment portfolio must experience an annual return of at least 2.55% to cover annual interest payments on outstanding debt. Based on assumed outstanding indebtedness of $245.2 million on an assumed 200% asset coverage ratio and an average cost of funds of 4.52%, the Company’s investment portfolio must experience an annual return of at least 2.56% to cover annual interest payments on the total debt outstanding. Based on assumed outstanding indebtedness of $423.9 million on an assumed 150% asset coverage ratio and an average cost of funds of 4.52%, the Company’s investment portfolio must experience an annual return of at least 3.10% to cover annual interest payments on the total debt outstanding.

Name, Address and Age(1) | | Position held with Company | | Principal Occupation DuringThe Board also discussed the potential impact that the incurrence of additional leverage may have on the Company’s net assets. If the fair value of the Company’s assets increases, additional leverage could cause net asset value to increase more rapidly than it otherwise would have if the Company did not employ such additional leverage. Conversely, if the fair value of the Company’s investments were to decrease, then the net asset value of the Company would decrease more rapidly than it would have in the absence of the utilization of such additional leverage. 7

Additional flexibility to make distributions required to maintain the Company’s tax status as a regulated investment company without violating the 1940 Act The 1940 Act currently prohibits the Company from declaring any dividend or other distribution to holders of any class of capital stock, in the case of debt securities, or Common Stock, in the case of preferred stock, unless its asset coverage with respect to senior securities is at least 200% (other than the Company’s SBIC debentures as permitted by the Company’s exemptive relief). By lowering the asset coverage requirements to 150%, the Company will have additional flexibility, subject to compliance with the covenants under any debt facilities, to pay distributions to Stockholders in order to be eligible for the tax benefits available to a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended. This additional flexibility may be helpful in circumstances where the value of the Company’s assets, and thus the Company’s asset coverage, declines, but the level of the Company’s net investment income remains relatively constant and, as a result, the Company continues to have cash available to make any necessary distributions to Stockholders. If the Company were to fail to make required distributions and no longer qualify as a RIC, the Company would become subject to corporate-level U.S. federal income tax. Impact on fees payable by the Company to Garrison Capital Advisers The Company is externally managed by Garrison Capital Advisers pursuant to the Past 5 Years |

Michael L. Butler (39) | | Chief Compliance Officer and Secretary | | General Counsel, Garrison Investment Group (April 2015 – present); General Counsel and Chief Compliance Officer, Hercules Capital, Inc. (October 2014 – March 2015); Associate General Counsel and Executive Vice President, Bain Capital (February 2010 – October 2014). |

___________

(1) | The business address of the officer is c/o Garrison Investment Group, 1290 Avenue of the Americas, Suite 914, New York, New York 10104. The officer holds office until his successor is chosen and qualified or until his earlier resignation or removal. |

Michael L. Butler has served as our Chief Compliance Officer and Secretary since May 2015. Mr. Butler has served as General Counsel of Garrison Investment Group since April 2015. Prior to joining Garrison Investment Group, Mr. Butler was General Counsel and Chief Compliance Officer of Hercules Capital, Inc. (fka Hercules Technology Growth Capital, Inc.), a business development company, from October 2014 until March 2015, where he had oversight of all legal and compliance matters. From February 2010 to October 2014, Mr. Butler was Associate General Counsel and Executive Vice President at Bain Capital, where he worked on transactional legal matters for investments by Bain’s credit fund and provided legal support for the management and purchase of portfolio companies. Prior to joining Bain, Mr. Butler was Counsel at TPG-Axon Capital from January 2007 to January 2010 and worked directly with the investment principals of TPG’s long-short hedge fund affiliate and acted as general counsel to portfolio companies in the United States, Europe and South America. Mr. Butler was previously an associate at Ropes & Gray from September 2003 to January 2007, specializing in private equity, venture capital and M&A transactions. Mr. Butler previously worked at Axiom Legal Services, Silicon Alley Venture Partners, The Exeter Group and Andersen Consulting. Mr. Butler received a J.D. and an L.L.M. from New York University School of Law. Mr. Butler received B.A. from Cornell University and an M.B.A. from the Judge Business School at the University of Cambridge. He is licensed to practice law in State of New York and the Commonwealth of Massachusetts.

Code of Conduct and Joint Code of Ethics

We expect each of our officers and directors, as well as any person affiliated with our operations, to act in accordance with the highest standards of personal and professional integrity at all times and to comply with the Company’s policies and procedures and all laws, rules and regulations of any applicable international, federal, provincial, state or local government. To this effect, the Company has adopted a Code of Conduct, which applies to the Company’s directors, executive officers, officers and their respective staffs. The Code of Conduct is posted on the Company’s website atwww.garrisoncapitalbdc.comand we intend to disclose any material amendments to or waivers of required provisions of the Code of Conduct on a current report on Form 8-K or on our website.